Roth Ira Income Contribution Limits 2025

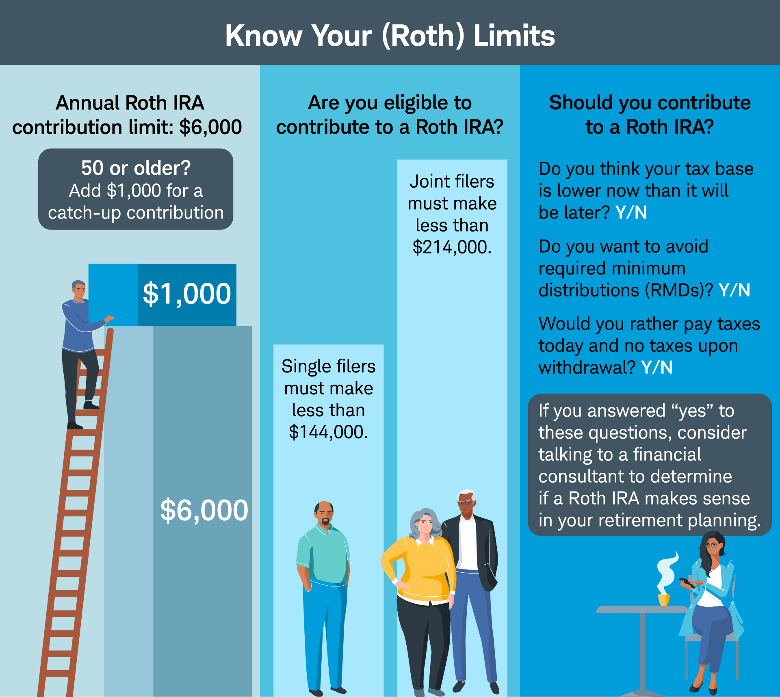

Roth Ira Income Contribution Limits 2025. You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older). And for 2025, the roth ira contribution limit is $7,000 for those under 50, and $8,000 for those 50 and older.

In 2025, the most you can contribute to all of your iras (traditional and roth combined) is $7,000. Are you trying to decide which retirement savings plan is best for you?

The maximum amount you can contribute to a roth ira for 2025 is $7,000 (up from $6,500 in 2025) if you're younger than age 50.

What is a Roth IRA? The Fancy Accountant, Roth ira income and contribution limits for 2025. Here are the roth ira contribution and income limits for 2025.

The IRS announced its Roth IRA limits for 2025 Personal, You can chip in an additional $1,000 if you are 50. If you're 49 and under, you can contribute up to $7,000 to a roth ira in 2025.

IRA Contribution Limits in 2025 Meld Financial, You can chip in an additional $1,000 if you are 50. Here are the roth ira contribution and income limits for 2025.

Roth IRA Contribution and Limits 2025/2025 TIME Stamped, Roth ira contribution limit 2025. After your income surpasses that, you'll enter the.

2025 Roth IRA & Contribution Limits What You Ticker Tape, In 2025, the most you can contribute to all of your iras (traditional and roth combined) is $7,000. After your income surpasses that, you'll enter the.

IRA Contribution Limits in 2025 & 2025 Contributions & Age Limits, $8,000 in individual contributions if you’re 50 or older. A roth ira is a retirement savings vehicle that can allow.

Roth IRA contribution limits aving to Invest, Are you trying to decide which retirement savings plan is best for you? You can contribute up to $7,000 per year to a roth ira (or $8,000 if you’re 50 or older).

Roth IRA Rules, Contribution Limits & Deadlines Best Practice in HR, You can make 2025 ira contributions until the. Who can contribute to a roth ira?

Roth IRA Contribution Limits 401(k) Plan Finance Strategists, Updated on january 28, 2025. That's up from $6,500 in 2025.

Roth IRA vs. 401(k) A Side by Side Comparison, But, for roth iras, you. In 2025, the annual contribution limit for both roth and traditional iras rises to $7,000 for those under 50, and $8,000 for those 50 and above.