Income Tax Rates 2025 Ireland

Income Tax Rates 2025 Ireland. In an effort to ease the ongoing cost of living pressures brought about by increased prices and inflation, the minister for. Price controls can act like a ratchet:

Standard rates and thresholds of usc for 2025; 20% tax is charged on the first part of one’s income.

The following tables show the tax rates, rate bands and tax reliefs for the tax year 2025 and the previous tax years.

Effective tax rates after Budget 2025 Social Justice Ireland, Calculating your income tax gives more information on how these work. In an effort to ease the ongoing cost of living pressures brought about by increased prices and inflation, the minister for.

2025 Tax Code Changes Everything You Need To Know RGWM Insights, In 2025, for a single person with an income of €25,000 the effective tax rate will be 10.3%, rising to 16.9% for an income of €40,000 and 39.0% for an income of. Tom maguire discusses the income tax system and what changes.

Tax Rates 2025 To 2025 PELAJARAN, If you are paid weekly, your income tax is calculated by: The rest of the income earned in ireland is charged at a higher rate of tax, which is 40%.

Irs Tax Brackets 2025 Chart Pavia, This is known as the standard rate band. Use deloitte’s income tax calculator to estimate your net income based on the provisions announced in the latest budget.

Tax rates for the 2025 year of assessment Just One Lap, From department of finance ; The amount on which the standard rate of tax is applied is known as the standard rate tax band.

Taxes in Ireland DubJobs, Your income up to a certain limit is taxed at the ‘standard rate’ of income tax, which is currently 20%. Rates and bands for the years 2025 to 2025.

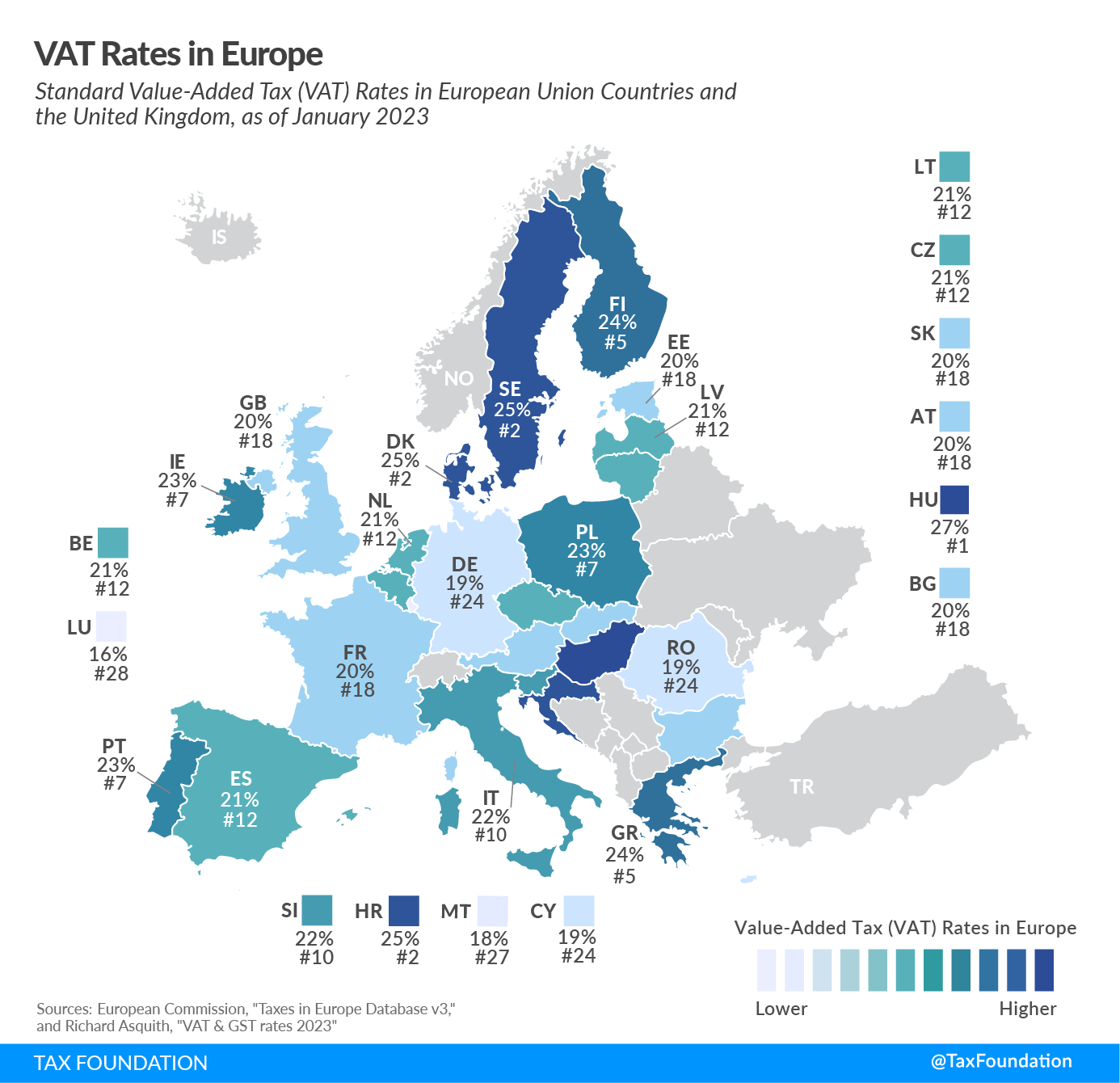

Value Added Tax Rates (VAT) By Country Tax Foundation, In 2025, for a single person with an income of €25,000 the effective tax rate will be 10.3%, rising to 16.9% for an income of €40,000 and 39.0% for an income of. The following tables show the tax rates, rate bands and tax reliefs for the tax year 2025 and the previous tax years.

State Tax Map 2025 Jeni Corabel, In 2025, for a single person with an income of €25,000 the effective tax rate will be 10.3%, rising to 16.9% for an income of €40,000 and 39.0% for an income of. The national minimum wage will increase by €1.40 to €12.70 per hour from 1 january 2025.

The Irish Taxation System trends over time and international, From department of finance ; Price controls can act like a ratchet:

Tax Brackets 2025 Irs Table Viola Maressa, Budget 2025 & finance (no.2) bill 2025. From department of finance ;